Will Mortgage Rates Remain Low Next Year?

As Corporate Transactions Attorney Benebell Wen so aptly reminds, we cannot predict, but we can project…

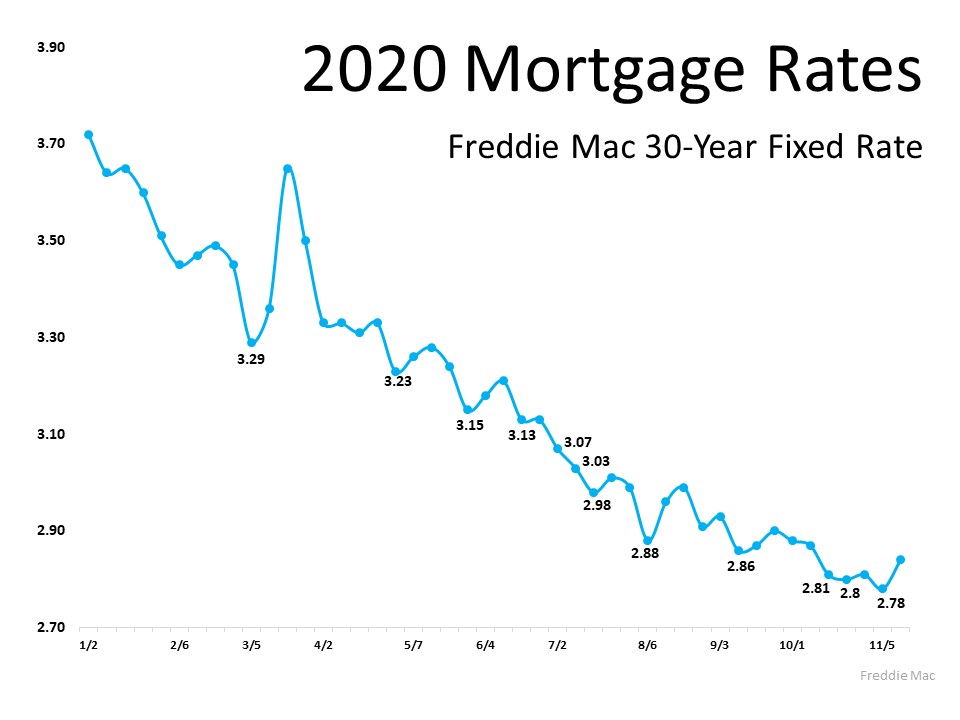

In 2020, buyers got a big boost in the housing market as mortgage rates dropped throughout the year. According to Freddie Mac, rates hit all-time lows 12 times this year, dipping below 3% for the first time ever while making buying a home more and more attractive as the year progressed (See graph below):

When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

The Challenge with Waiting

The challenge with waiting is a lot like the challenge of trying to predict the future. The truth is the future is not predictable, but projections can be made. Last week, mortgage rates ticked up slightly. Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates jumped this week as a result of positive news about a COVID-19 vaccine. Despite this rise, mortgage rates remain about a percentage point below a year ago.”

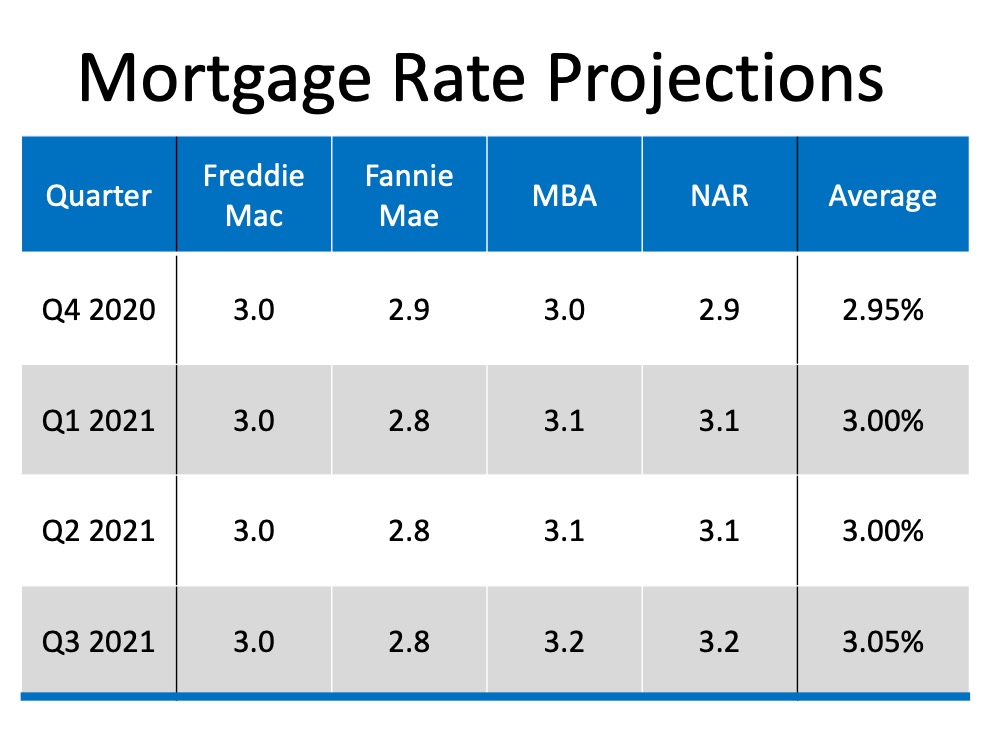

While rates are still lower today than they were one year ago, as the economy continues to get stronger and the pandemic resolved, there’s a very good chance interest rates will rise again. Several top institutions in the real estate industry are projecting an increase in mortgage rates over the next four quarters (See chart below): If you are planning to wait until next year or later, Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), forecasts mortgage rates will begin to steadily rise:

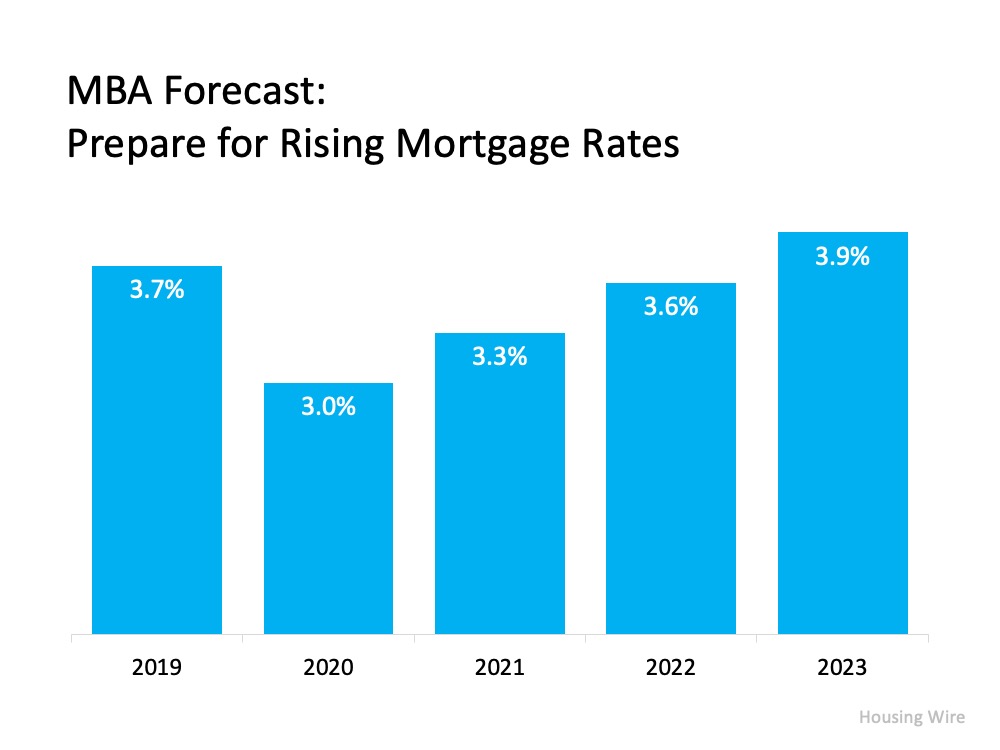

If you are planning to wait until next year or later, Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), forecasts mortgage rates will begin to steadily rise: As a buyer, rather than trying to predict the future, I encourage you to consider if waiting makes financial sense for you.

As a buyer, rather than trying to predict the future, I encourage you to consider if waiting makes financial sense for you.

If you have determined that now is the time for you to maximize your purchase power by locking in a low rate, then reach out.

I would love to work with you to realize your real estate investment and lifestyle goals.